Hi Everyone,

As readers might know, I have been aiming for 2 bedroom condo ever since I started this blog, or should I say way before I started this blog (in wordpress). Condo is the choice that I choose to go for due to some reasons that requires me to do so.

Understand that many people might think I might leverage too much just to purchase a condo, but sometimes people must take risk in order to achieve higher goals. My fiancee and my goal are pretty similar, is to able to generate enough passive income for our retirement. I believe this is the goal for everyone.

Why condo? many might asked. The reason why I choose condo over HDB resale flat, I believe I have mention in my first few post, but I don’t mind mentioning again, the reason is because of investment opportunity. Some people might say that getting HDB will have better resale values and able to earn much more as compared to condos. Yes it might be true but the fact is that it really applies to BTO flats in a good location (some even fetch million).

In addition to that, I choose to purchase condo is also because of the investment opportunity, whereby my wife is able to purchase or retain her current condo to gain rental yield. Of course, subtracting the interest and the monthly repayment to the bank, it might not left much but still might have 100 to 200 dollars left per month.

Well, 100 to 200 dollars is a pretty good return and is a start of the journey, because after the loan period is over, we will be getting around 2k for the rental which is quite a good sum of money after we hit our 60s (if we still keep that condo). So for this property, we can already put one side and not to touch it and let it generate passive income for us (which is pretty good deal).

But of course, nothing is smooth, we also consider that what if no one rents our place? or what if every month instead of getting 100 to 200 dollars, we need to pay 100 to 200 dollars even if we manage to rent? Of course, money needs to be managed, that’s why it is important to understand your risk appetite before purchase big ticket item.

How much do I need to make down payment for 2 bedroom condo?

There is no fixed amount that you need to have in order to purchase 2 bedroom condo, because it will have to depend on the price of the condo that you wish to purchase. Some might cost around 600K++ and some might cost around 800K++. So it really depends. For me, of course if can get it cheaper, i will go for cheaper but in decent location. So let’s say I aim for 650k condo, with a rough estimation of 23% down payment (including lawyer fee and etc.) It will cost around $149,500 for the down payment. Quite high isn’t it. As I am still below 30s and just started working, how am I going to achieve that amount?

To tell you the truth, it is indeed hard, especially that now, I have to spend 20K+ for my wedding (of course I am happy for the wedding but it put stress in achieving that target). Really, can someone able to save 45K in just 1 year 2 months? That is pretty much insane isn’t it. Of course my 45K includes CPF (Central Provident Fund). So let’s us do a break down! Why $45K, you might think, it is because this is a target that I set for myself to hit before I purchase a condo.

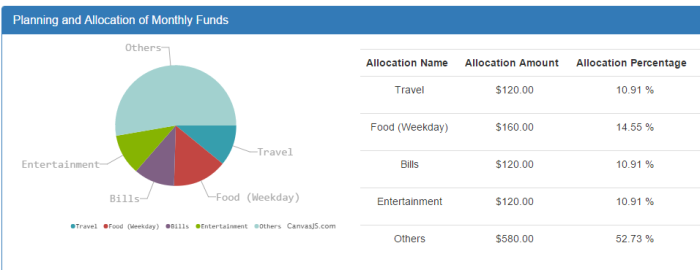

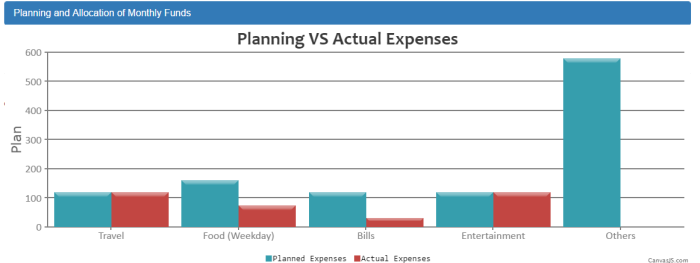

I earn around 4K and I break down into details.

Net Salary: $3.2K per month

Ordinary Account: $920 per month

Passive Income: $130 per month

Expenses: 1.2k per month

So if based on the figures above, I am able to save around $3,050 per month (excluding bonus). So in the range of 14 months, the calculation will be shown as below:

$3,050 * 14 months = $42,700

Still fall short for $2.3k but if we include bonus for lets say 3 months, we will have additional 12k more to the total which hit $54,700! Of course there are variables that we have yet to include. Like my increment, possible of raise in passive income, CPF interest and etc. With that, hitting my dream goal will not be an illusion but a reality. So with a mere 1 year 2 months, I can attain more than 50k savings which is quite an extensive amount!

So finance management is really important in order to achieve your goal. If you lost control of your finances, and anyhow spend, it will cost you a lot. But of course, savings is important but living your life comfortably is as important as savings. Try not to starve yourself just to save that small amount of money. It is not worth it. If you cannot achieve that goal, try to extend 2 more months or 3 more months in order to get your desire goals.

For me, well, I will be reporting my monthly update to let you reader know where I have hit that target. But of course, I need to spend money on wedding as of now, so might be a little tough to follow through for the first few month. We shall see how it progress!